IDR

Intelligent Data Recognition

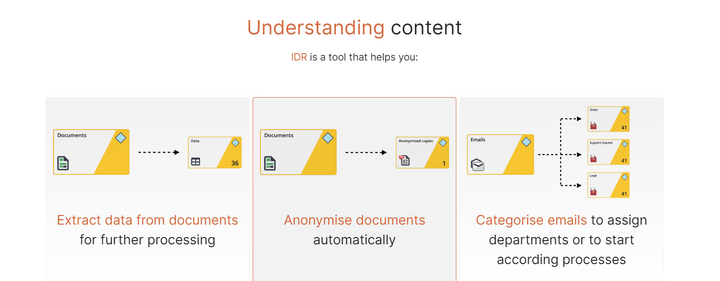

IDR (Intelligent Data Recognition) is a tool that uses OCR technology which helps to analyse data from documents uploaded into the system and automatically exports them to JobRouter® or integrated with JobRouter® financial/accounting system.

In IDR, OCR works as a ‘lasso’ that scans inserted documents in order to find keywords with their assigned values, no matter which fonts were used. The system can be integrated with databases inside the company (contractors, orders), public databases (Central Statistical Office, National Court Register) and with vocabularies, which help to verify the correctness of recognised values.

What are the benefits of using IDR?

The main benefit of using IDR is time-saving in the process in which employees normally would have to search and manually type the data from invoices into the financial/accounting system. Invoices in IDR can be also automatically exported to the electronic archive with a scanned original document attached. In the archive, they can be searched with keywords in the full-text dimension.

How does IDR work in the invoice approval process?

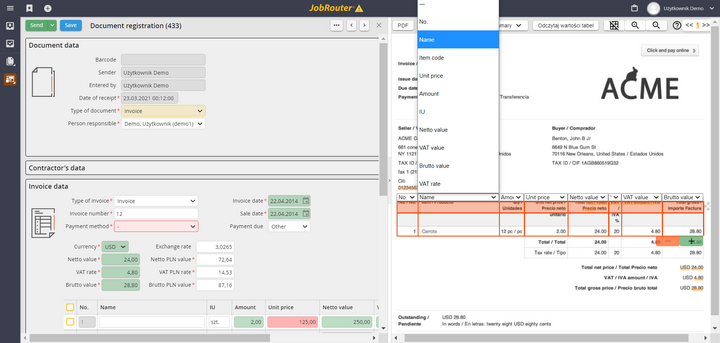

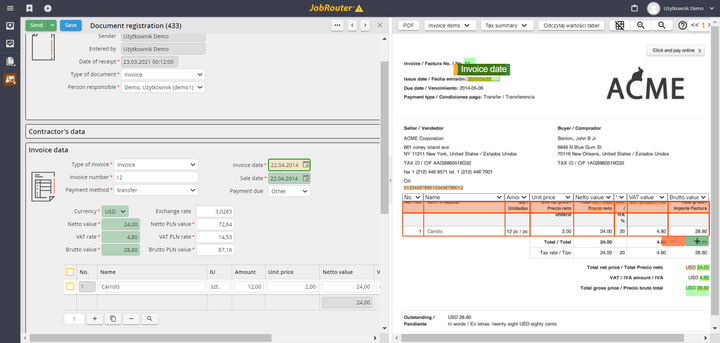

After converting an image into text (a scanned document or an invoice in a pdf, jpg file received electronically) the IDR engine exports the data to the accounting system or the invoice circulation system in the appropriate fields.

Algorithms that are part of the system, search the recognized content in order to find VAT number, invoice number, net amount, gross amount, item number, address or date. Finding keywords such as the invoice number or the date of issue of the document allows the system to classify the phrases in the vicinity of the keywords into the correct fields. In addition, when it is possible, it verifies the text format (e.g. whether a given value is a date), a check digit (e.g. Tax identification number), and also analyses the compliance of the identified data with the ERP system database or financial/accounting system.

Benefits of using IDR:

- Significant reduction in the time of entering invoices into the accounting system

- The possibility of electronic approval of the invoice before entering it into the accounting system

- Verification of inaccuracies in the invoice (e.g. by comparing the data on the invoice with the data from the Central Statistical Office or VIES.

- Paper decommissioning - by replacing paper with system data, approval processes can take place electronically within the workflow system. Paper does not circulate within the organisation, and the approval of electronic documents or individual invoice items can take place simultaneously, which speeds up the booking of invoices.

- Reporting - extended financial reports can be generated in real-time - combining data from the accounting system with data from the approval process gives a picture of liquidity including costs not yet booked.

Features

- IDR is a learning system, so each invoice expands the performance charts of finding data in a given place on the invoice, assigning it to the tax identification number of the invoice issuer.

- It analyses the compliance of the identified data with the ERP system database or financial/accounting system.

- It allows to approve the invoice before entering the accounting system.

- Product

- Add-on

- Databases

-

- Microsoft SQL Server

- MySQL/MariaDB

- Oracle

- Languages

-

- English

- French

- German

- Polish

- Romanian

- Slovak

- Supported JobRouter® version

- from version 5.0

- Created

- Updated

Note: Please contact your support partner to check whether the product is compatible with your existing IT landscape.